The London Market Group launched a campaign in mid-2018 to build enthusiasm for, and increase, the adoption of electronic placement through PPL. The campaign aims to demonstrate the importance of embracing modernisation in order to maintain the competitive edge of the London Market.

The campaign complements PPL’s own market activities and the Lloyd’s mandate to collectively make the move away from paper, remove unnecessary admin and provide a faster service for our customers.

As part of measuring the campaign, the latest research was conducted in December 2018 with over 300 market participants, split across broker and carriers, sharing their views. These responses were compared to prior research conducted in July 2018.

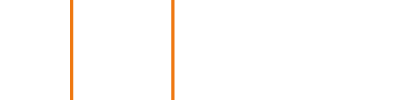

The survey identified that knowledge of PPL has increased among both underwriters and brokers since the last survey. Knowledge within non-users has also increased at a higher rate, suggesting that awareness is now reaching non-users more effectively.

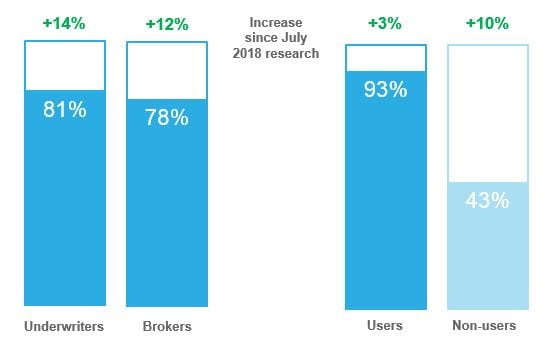

In addition to an increase in awareness, the research results have told us that positivity towards PPL has also increased, particularly amongst brokers – by almost 10%. Another positive step is that the number of people who said they were not likely to use PPL has reduced. Overall, these survey results show the market is embracing PPL.

This is also supported by PPL usage statistics, where the number of risks bound by PPL increased by over 200% through 2018, with 38,575 risks bound during the year compared to 12,776 risks in the equivalent period at the end of 2017. Over the same period, the number of endorsements requested increased by over 500%.

In 2018 there was a 140% increase in the number of users on the platform, (from 5,000 to 12,000 users) with a 42% increase in carrier firms signed up to PPL and 114% increase in broking firms signed up.

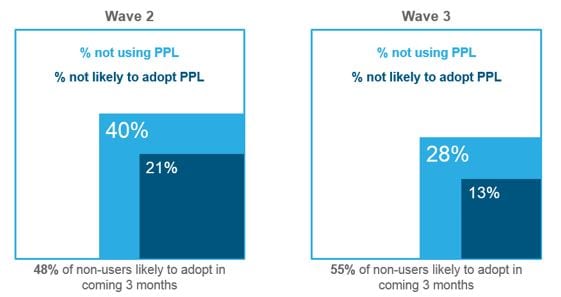

The perceived benefits of PPL have broadly stayed consistent across the different research phases:

As we continue with the campaign, we’ll be looking to reinforce that the quality of face-to-face conversations remains the same and PPL, when used correctly from quote-to-bind, provides a central efficient platform for placing risks. The research demonstrated that benefits are being achieved through the use of PPL today and we must focus on building on the momentum that has been achieved to ensure the majority of the market moves forward with online placement.

Modernising the London Market, will benefit our customers with faster, more efficient placement. PPL not only supports risk placement, but builds the foundations for making London an easier and more cost-effective place to do business, opening wider opportunities to compete on the global stage.