Strong trading volumes and improved service delivery during a key peak renewal season

Placing Platform Limited has confirmed continued strong and stable performance during peak June and July renewals. Throughout 2024, platform and service performance has continued to improve, with these gains sustained during the key half-year renewal season.

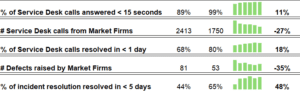

After transitioning to the new platform, clients experienced a challenging Q4 2023 and initial start to 2024. In response, PPL implemented a range of remediation and performance initiatives, resulting in a marked improvement in platform performance and service responsiveness. At the end of June, key performance indicators stood at:

- 99% of calls to the Service Desk answered within 15 seconds, up 12% from January

- 80% of service requests raised by market firms resolved within one working day, up 18% from January

- 29% reduction in market raised tickets between January and June

- No reported performance issues over quarter end

In addition, the number of system defects raised by market firms has fallen by 35%, reflective of the success of the regular release schedule focused on rapid fix, enhancements and continuous improvement.

PPL platform performance and service delivery was sustained during one of the busiest periods of trading in the London Market. For H1 2024, PPL digitally processed and placed c.90k risks and c.300k carrier lines.

Colin O’Malley, Chief Operating Officer at PPL, said:

I am pleased to report that PPL has been able to return to supporting our clients effectively, following the challenges of transitioning to a new technology base. It was essential for our clients that we sustained these improvements during a peak renewal season as we seek to re-build confidence.

We are not yet at the levels of performance and support we aspire to, and we will continue to keep pushing.

The whole PPL team has worked incredibly hard to drive an integrated continuous improvement programme during 2024. This included implementing a regular fix and enhancement schedule, process improvements and a deeper client support and service model. A good example of this is the continued advancement of the Learning Management System that’s been used by 6,500 users from across 300 companies benefiting from video content that works towards CPD training.

We can now turn our attention, as we had hoped to do all along, to building out a wider ecosystem of trading tools that enable brokers and underwriters to place risks effectively and efficiently. A process that has begun with our API programme and will be rapidly followed by a step change in user experience and introduction of Digital Contracts.